Say Goodbye to Paper Receipts

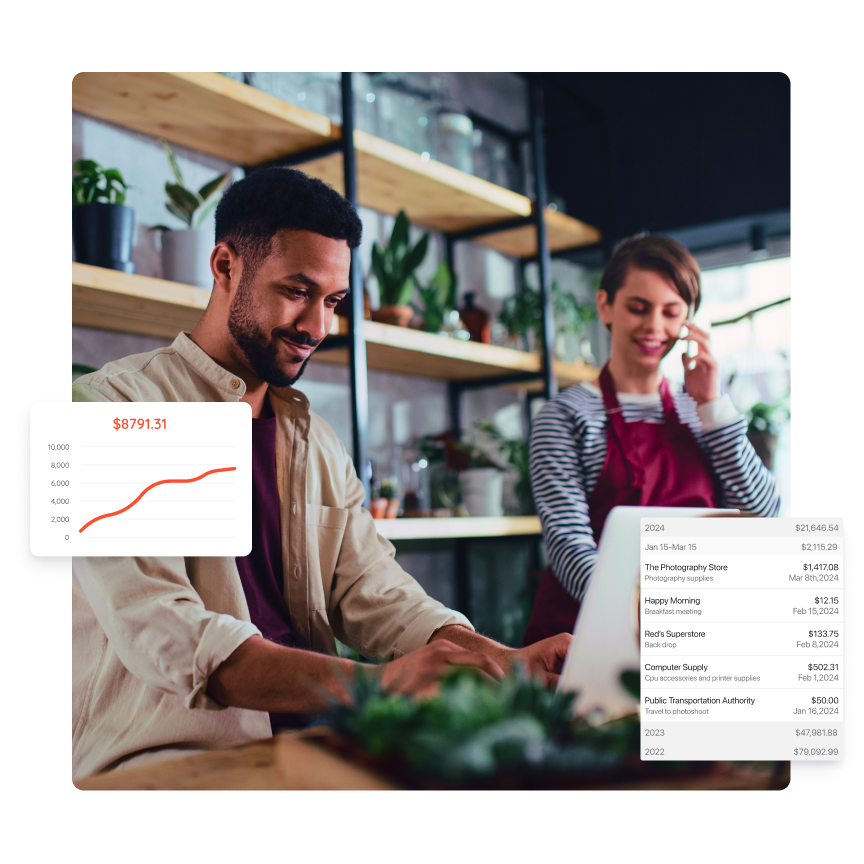

Some goodbyes are easy, especially when it’s throwing out a cluttered box of paper receipts. With Invoice Simple’s Expense Tracker, you can create digital records of receipts in seconds. The in-app receipt scanner captures and stores expense details in Invoice Simple. And because it’s all through our mobile app, our Expense Tracker works where you do—from the office, in the field, or on the road.

Scan

Use your mobile device camera to scan and automatically capture receipt details.Expense

Quickly create a new expense from the scanned receipt details with just a click of a button.Export

Generate expense reports for any date range. Reports are exported as email-and-printer-friendly file formats.Relax

Have your deductibles in a row this tax season. Easily search and export your yearly expenses.

What is a Business Expense Tracker?

A business expense tracker is software that helps businesses record, organize, and monitor financial expenditures such as supplies, travel expenses, and marketing costs.

With Invoice Simple’s mobile app Expense Tracker, you can:

- Scan receipts to capture details automatically

- Create digital records of business expenditures

- Export expense reports to track spending

- Simplify reimbursing employee expenditures

By logging expenditures, expense trackers provide insights into spending patterns and inform budgeting decisions.

Simplify Tax Preparation with an Expense Tracker

Dread tax season? We’ve got your back. You’ll be relaxed and ready to file your taxes thanks to Invoice Simple.

An expense tracker gives you:

- Digital copies of your receipts

- Deductibles organized by category

- Confidence your records are accurate

- Detailed reports for any date range

With every expense recorded in one place, filing taxes becomes a streamlined, stress-free process.

How an Expense Tracker Can Benefit Small Business

There isn’t just one benefit to having an expense tracker. A small business can improve financial organization, workflow, and overall efficiency.

Specific benefits include:

- Enhanced Financial Records: Centralizing your expense data in one place eliminates the need to keep track of paper receipts.

- Time-Savings: Scanning your receipts reduces manual data entry, mitigates errors, and makes it a breeze to search expenses in the future.

- Easy Tax Preparation: Don’t sweat tax season! An expense tracker means you have a reliable, easy-to-search record of your yearly expenditures.

- Improved Cashflow Management: Tracking expenses in real-time allows you to spot spending trends and manage your cash flow effectively.

In short, automating expense tracking is a simple, effective way to enhance daily operations for small businesses.

Receipts On-the-Go

Take a photo in-app or upload from your phone.Capture All Details

All receipts details are captured and saved automatically.Save Time

Scan once and the receipt is there when you need it.FAQ

Our AI-powered receipt scanning is incredibly accurate. The most important step is taking a clear photo of the receipt. Invoice Simple will automatically and accurately record the key information. Additionally, you are able to review and edit expense details before saving.

Utilizing a business expense tracker like Invoice Simple can benefit your small business in numerous ways. Expense tracking helps business owners prevent fraud, simplify tax accounting, and improve budget management. For employees, expense tracking enhances the speed and efficiency of reimbursements, which prevents frustration with delayed or incomplete repayment. Managing expense tracking through software like Invoice Simple consolidates your financial data in one place. That way, you can analyze spending patterns over various periods, such as monthly, quarterly, or annually.

Yes. Invoice Simple is a mobile application compatible with iOS and Android devices. You can scan receipts, track expenses, and generate reports with your mobile device. Expense tracking from your mobile device ensures flexibility and convenience whether you work in the office or the field.

Expense tracking streamlines tax preparation by systematically recording and organizing yearly expenses. With Invoice Simple’s expense tracker, you can export summary reports, providing a clear overview of deductible expenses. Not only does it improve the filing process, but it helps ensure compliance.

Absolutely. Invoice Simple’s expense tracker enables you to export summary reports. Set custom date ranges to detail expenditures. Quickly share reports with your accountant to simplify tax deductibles. This feature also aids in financial analysis and record-keeping.

To effectively track business expenses:

- Identify Qualifying Expenses: Recognize deductible business expenses such as advertising, office supplies, and travel costs.

- Centralize Finances: Use dedicated business bank accounts and credit cards to separate personal and business expenditures.

- Utilize Expense Tracking Tools: Implement tools like Invoice Simple’s expense tracker to record and categorize expenses efficiently.

- Maintain Organized Records: Regularly update and review expense records to ensure accuracy and readiness for tax season.