What is “Net 30,” & What Does it Mean on an Invoice?

Net 30 is a payment term for invoices. When this term is included on an invoice, it means the customer has 30 days to pay the total. With net 30, you’re extending credit to your customer and allowing them to purchase services and products without paying upfront.

Another term for extending credit to customers is trade credit. This is a business-to-business agreement that works on payment terms, often net 30, 60, or 90.

In this article, we’ll explain the benefits of net 30 and how you can use this payment term to make sales and purchases for your business.

What Is the Difference Between Net 10, Net 15, And Net 30?

Net 30 isn’t the only payment period you can include on an invoice. Common variations include net 10, net 15, and even net 60. The difference is simple. The number indicates how many days the customer has to make their payment.

Net 10 means payment is due 10 days after the invoice date. Net 15 means payment is due in 15 days. Net 60—you guessed it—signifies payment is due 60 days after the invoice date.

So, which term length is right for your business?

One compelling reason to choose a shorter term length—like net 10 over net 30—is to be paid faster. If you work with tight margins, you may not be able to wait a full 30 days for payment.

In contrast, you might choose net 60 or longer if your product requires a longer lead time to deliver. Rather than having a customer pay for a product or service you can’t deliver for months, you can let your customer choose if they want to make the payment earlier or closer to the delivery date.

When Does Net 30 Start?

In most cases, the 30-day countdown begins from the date that the invoice is issued. So, if a net 30 invoice is issued on January 1st, the customer must pay on or before January 30th.

But there are other variations you can use for calculating the due date. Common variants include 30 days after purchases are made, services are delivered, or the work is complete.

Regardless of how you calculate your payment terms, communicate them clearly to your customers to avoid confusion or late payments.

Does Net 30 Mean 30 business days?

Net 30 may seem like it means 30 business days. However, in the world of invoicing, it typically means an unbroken 30-day period. This includes weekends and holidays.

Of course, terms can vary from vendor to vendor. If you want to give customers more time, you can choose to exclude weekends and holidays from your payment terms. Payment terms are decided by the seller. You can customize your terms to fit your business.

How do net 30 terms work?

Could net 30 payment terms be right for your business? Let’s explore how net 30 works when you offer it and when you use it to make business purchases.

For Those Looking to OFFER Net 30 Terms

As discussed above, offering net 30 terms requires extending credit to your customer. Often, you’re delivering service or goods without upfront payment. This means your business has to have adequate cash flow to cover the delayed payment.

If your business is just starting out, offering extended payment terms can be difficult. You could find yourself short on available cash and waiting for payments to come in. In that case, offering payment terms may not be the best option for your business.

There are options to offer net 30, though, and reduce your own risk. You can work with companies that offer trade credit financing.

Similarly, if you offer net 30 and accrue a large amount of delinquent invoices or need payment immediately, you can partner with an invoice factoring company as a fallback. However, it does come with a drawback.

Invoice factoring is a funding model where you sell your invoices to a third-party company. That company pays a percentage of your invoices—typically 90% of the total—to you upfront rather than waiting 30 days.

The invoice factoring company then sends the invoice to the customer. The customer pays the third-party company the invoice total according to their payment terms. When payment is made, the invoice factoring company sends you the remaining 10% of the invoice total minus a small processing fee.

While you’re paid upfront, you lose a small percentage of every invoice. If you’re considering invoice factoring, evaluate if your profit margin is large enough to absorb the loss of the processing fee.

For Those Looking to USE Net 30 Terms

A major challenge of business is that you have to purchase supplies and products in order to deliver services to your customers. This means spending money before you can make money. However, as a business, you can also utilize payment terms to purchase supplies and products.

You can use trade credit to purchase the materials and products you need without paying upfront. Instead, you’ll agree to payment terms, often net 30, 60, or 90.The advantage of trade credit is that you can make sales before paying for the necessary materials. In other words, you make money before you spend money.

If your business has limited cash flow, trade credit can help you make necessary purchases without stretching your finances. The most important thing is to make on-time payments to avoid accruing interest or paying late fees.

Remember, payment terms vary per vendor. Do your research to find the terms that work best for your business. Building a relationship with a trade credit vendor can help you purchase business supplies without breaking the bank.

When Should You Use Net 30?

Net 30 terms can be a powerful tool for both selling and buying in business. But it’s not always the right move. Here are a few things to consider.

For Those Looking to OFFER Net 30 Terms

Examples of businesses that may want to offer net 30 terms include:

- Businesses that provide complex services, such as construction, remodeling, or repairs.

- Digital product vendors that require multiple payments for each order they process.

- Retailers that sell higher-end items with longer lead times to fulfill orders.

On the other hand, payment terms may not be the best option for businesses in certain situations:

- Businesses that experience high rates of default, such as seasonal or niche market businesses.

- Companies that can’t tolerate delayed payments from customers due to tight on-hand cash reserves.

For Those Looking to USE Net 30 Terms

Reasons you may want to use net 30 for your businesses include:

- Building your business credit by working with a vendor that reports to credit bureaus.

- Breaking up larger purchases over the length of the term to reduce the financial impact.

- Increasing your purchasing power beyond what you can pay in full immediately.

However, you may want to avoid net 30 invoices due to the following:

- The added labor of managing multiple outstanding invoices.

- Facing late fees for overdue invoices.

- Potentially accruing interest on invoices

Need to create a professional Invoice?

The Benefits of Net 30

As a business owner, you’re likely interested in using payment terms to land more customers. But they are equally beneficial for you to use in your business purchases.

Here are the benefits of net 30 terms for selling and buying products and services.

For Those Looking to OFFER Net 30 Terms

Bring these benefits to your small business by offering payment terms to your customers.

- Offer Payment Flexibility

Net 30 allows customers to purchase services without the demand of immediate payment. This can motivate customers to make purchases earlier rather than waiting for the next payday.

- Reduce Bad Debt

Customers are more likely to be able to pay within a 30-day window rather than tight payment deadlines.

- Gain a Competitive Edge

Net 30 payment terms can set you apart from competitors. The flexibility of net 30 can tip the scales in your favor if competitors only offer strict payment terms.

- Build Customer Relationships

Extending credit can build trust between your business and its customers. It can also help create a strong base of repeat customers, resulting in steady income.

- Motivate Early Payments with Discounts

Many vendors use discounts to incentivize early payment. This could be a 1-to-2% discount on the invoice total when payment is made within a specified number of days. If you see an invoice with the terms “2/10 net 30”, this means the vendor is offering a 2% discount if the invoice is paid within 10 days. “1/15 net 30” would mean a 1% discount if payment is made within 15 days during the 30-day term length.

For Those Looking to USE Net 30 Terms

Payment terms can not only help your customers but help your small business too. There are many vendors who supply businesses with products and services using the net 30—or net 15, net 60, etc.—payment model.

Purchasing materials on terms offers several benefits for your small business.

- Easily Secure Credit

Net 30 payment terms give you a line of credit without the need to offer up personal guarantees or sign on to one-sided loans.

- Helps Build Your Business Credit

Many trade credit vendors report to credit bureaus. By making on-time payments, you can grow your business credit with your net 30 accounts. Eventually, you’ll be able to secure more extensive credit terms to increase your capital. Make sure to confirm which credit bureaus, if any, your vendor uses for reporting.

- Flexible Repayment Terms

Just like for your customers, the flexibility of payment terms can be a good option for your business. You can choose when—within the 30 days—to make your payment. This gives your business financial flexibility and breathing room.

The Drawbacks of Net 30

While net 30 offers many benefits, there are risks. Consider the drawbacks first if you want to offer or use payment terms.

For Those Looking to OFFER Net 30 Terms

Here are some of the most common negative impacts terms can have on businesses:

- Cash Flow Issues

Offering terms on invoices delays payment for their services or products up to 30 days after an invoice is sent. This can create problems with cash flow and budgeting.

- Administrative Costs

Businesses offering payment terms must manage the extra paperwork associated with delayed payments. This may mean you need additional staff to help with the administrative responsibilities.

- Unreliable Customers

Not all customers are reliable. You could see an uptick in unpaid invoices. While this is a risk, there are steps you can take to handle unpaid invoices.

Small business owners can make an informed decision by knowing the potential risks associated with payment terms.

For Those Looking to USE Net 30 Terms

- Accruing Interest

Payment terms can be a great way to make purchases before you have business credit. However, in some cases, you may end up paying more. Some vendors charge interest on trade credit payments that are not paid by the due date.

- Facing Unclear Terms

Due to variations in payment terms, it’s not always clear when payment is due. If vendors include vague terms, you could face late fees or be forced to pay interest on invoices.

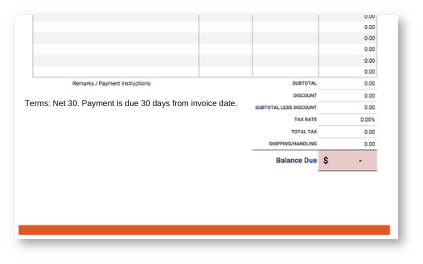

How to Add Net 30 to an Invoice

It’s simple to add payment terms to your invoices. You write it in the invoice’s conveniently named “Terms” section, then add important details to define the terms you’re using.

Creating a contract with your customer? Include the net 30 terms here as well. By including it in your agreement, you protect your business from potential conflicts with customers in the future.

Net 30 Payment Terms Wording

There are a few important things to keep in mind for payment terms wording. First and foremost, it’s essential to spell out the terms on every invoice. As we’ve discussed, payment terms can vary from business to business.

In the invoice term section, write “Net 30”. Then, define the payment terms further. Is the invoice total due 30 days from the invoice date or from when work is completed? Make sure there’s no confusion so you’re paid on time.

Example wording: “Terms: Net 30. Payment is due 30 days from invoice date.”

If you’re offering an early payment discount, include that in the terms too. This would be writing something like “2/10 net 30”. This lets the customer know they will receive a 2% discount if they pay within 10 days.

It’s also important to define any consequences for delinquent payments. Indicate the fees or interest charges that will be applied after the 30-day period expires.

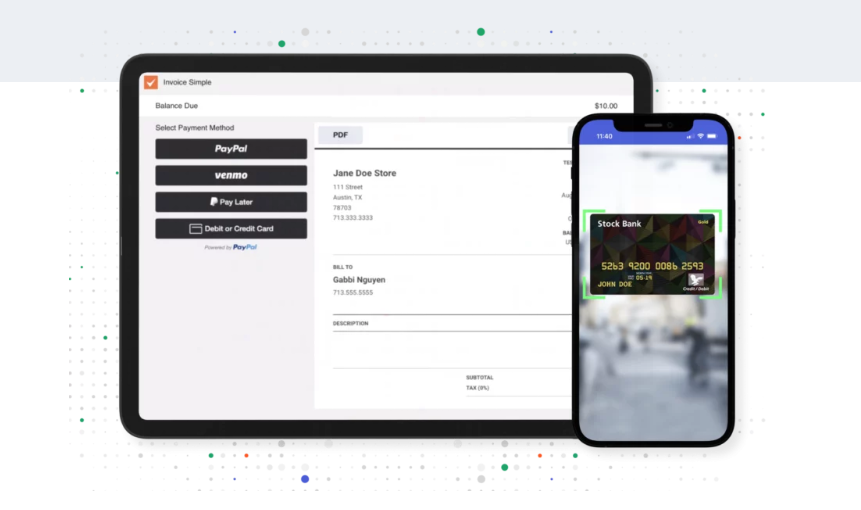

Did you know? Invoice Simple users can add Net 30 wording to the note section of their invoices. Try it for free!

KEEP READING: How to Write a Strong Invoice Email

Other Customer Financing Options

For small businesses, net 30 terms might not be the most feasible option. Extended payment periods can strain cash flow and make it difficult to hold customers accountable for their payments. But larger companies may still expect net 30 terms from their vendors, leaving small business owners with few alternatives.

Fortunately, several financing options are available to small business owners that allow them to offer their customers more options while still maintaining their cash flow.

For example, PayPal’s Pay in 4 option allows customers to pay in four interest-free installments over six weeks. If you’re an Invoice Simple user, Invoice Simple Payments lets you link your professional invoices to PayPal’s Pay in 4 service. This means you can offer net 30 terms without extending too much credit.

By taking advantage of these services, you can ensure that your customers get the payment options they need.

Start Your First

Invoice Today

Create customized and professional

invoices and connect with clients