Unpaid Invoices: A Simple Guide For Freelancers & SMEs

We recently highlighted the vast amounts of money lost to freelancers and SMEs each year due to unpaid invoices.

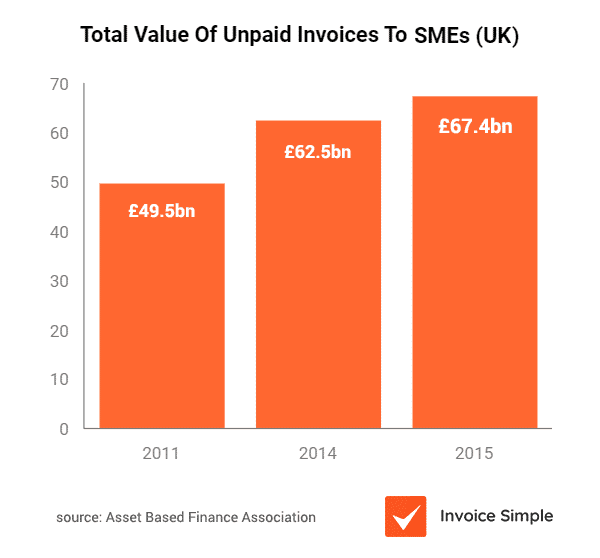

A 2017 study by Fundbox estimated that small businesses in the USA are owed $825bn, while in the UK SMEs are due £67.4bn (and rising).

So if you’re a freelancer or SME struggling to get paid, what are your options?

In this guide we’re going to cover:

- How to reduce non-payment issues

- How to chase up unpaid invoices

- What to do if your client still won’t pay

We’ll start by covering something we believe strongly should be standard practice for EVERY freelancer and SME.

Prior To Commencement: Be CRYSTAL Clear On Expectations

Before you start work, it’s important to be 100% clear on what is expected from both you and your client:

- What services will you be providing?

- What is the expected timescale for delivery?

- When are payments expected?

Our advice?

Create a simple contract prior to commencement, which sets everything down in black and white.

This will help to avoid any misunderstandings, and can also be used as a reference for disputes.

And to be clear:

We recommend you do this for EVERY job, no matter how small.

It’s easier than you think to create a contract. The Freelancer’s Union has a free online contract creator you can use to create an agreement.

And we’d also recommend checking out this pretty detailed guide.

Consider Asking For Payment In Advance (Or Use An Intermediary)

The best way to mitigate non-payment issues?

Get paid for your work upfront.

We’ll be honest: that’s going to be tougher to do when you are starting out.

But once you are established, then in many industries it’s common practice to ask for a partial (or even full) payment in advance.

Setting the upfront payment at your “cost” is a good idea. That way if there are any issues with the balance, at least you won’t be out of pocket.

If you’re a freelancer, another option is to use sites such as Upwork as an intermediary.

For fixed price projects, money is placed in Escrow by the client, and released to the freelancer on project completion or when various “milestones” are met:

The downside? You’ll have to pay a fee to the intermediary for using their service. And that can eat into your margins.

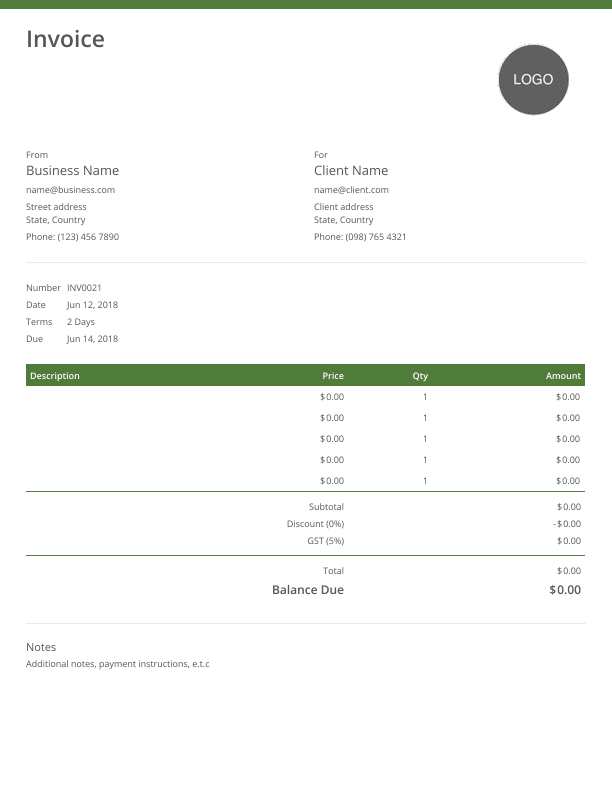

You’re A Pro Right? So Send A Professional Invoice

It might seem like a no-brainer.

But getting paid for your work starts with sending an invoice. And you would be surprised shocked how many freelancers and SMEs skip this step.

Email, or Paypal requests for payment are more likely to be missed (or ignored).

A professional looking invoice on the other hand? That shows your client you are serious about your business.

And serious businesses are more likely to get paid. It’s just the way of the world.

The good news?

You don’t need to fork out for expensive accounting software to create a professional invoice.

You can send 3 invoices for free using our invoice generator (only $2.99 per month after that), or download one of our (also free) invoice templates.

Chase Up Payment: It’s YOUR Money

Here’s the thing:

A lot of freelancers lose money because they simply don’t chase up payment. Perhaps they’re afraid to lose future work from the client. Or maybe they just think chasing seems a little “desperate”.

But if you’re running behind on a project you can bet you’ll be getting emails and phone calls from your client. So if they’re late with payment shouldn’t you do the same?

You don’t have to be aggressive. Just a simple reminder email or letter once the invoice is a week or so behind can do the trick.

After all, your client might have genuinely forgotten to pay the bill. It happens.

And on that note:

We recommend that you keep track of when all your invoices are due.

Most invoicing software (including ours) will do that for you automatically. Or if you prefer, you could simply keep note of invoice due dates in a calendar or diary*.

*but using our app will save you a TON of time 😉

What To Do If Your Client Still Won’t Pay

Polite payment reminders not working?

Unfortunately, you’re going to have to choose whether to escalate.

The good news is: you have options.

The bad news is: most of those options are going to cost you some upfront cash.

So you’re going to have to weigh up whether it’s worth outlaying (and potentially losing) extra money to get what you’re owed.

Convinced that it is? Then here’s what to do.

Unpaid Invoices In The USA: Going Legal

If you’re in the US, and your client isn’t paying, then you’re going to have to engage a lawyer.

The first step will normally be for your attorney to send a formal demand for payment.

A scary looking legal letter can often do the trick.

But if that doesn’t work, then unfortunately you’ll have to consider suing the client for the money you are owed.

This is going to be expensive. So we’d only recommend this course of action if:

- You’ve exhausted all other options for getting the money, i.e. the client is simply ignoring you

- You think the value of the outstanding debt is worth the outlay

- You believe the client can actually afford to settle the debt

And if you do go to court, having that signed contract we mentioned at the start is going to be crucial.

Unpaid Invoices In The UK: Small Claims Court

If you’re in the UK, the legal process for collecting an unpaid debt is (relatively) simple.

You can use the small claims court to chase debts of:

- under £10,000 in England and Wales

- under £5,000 in Scotland

- under £3,000 in Northern Ireland.

There’s a fixed fee for registering your claim, but it does vary depending on the size of the outstanding debt. According to Which, the fees range from £25 for debts under £300, up to a maximum of £455.

You don’t need a solicitor to register your claim. You can do it yourself online (gov.uk) or by post (form and instructions here).

Note: a small claim does not guarantee payment. If you win the claim, you will be able to escalate further, but this is going to incur more costs. Often however, the fact that you are willing to go to court will be enough to make the client pay up.

Bonus Tip: Consider Joining A Trade Body

Escalating non payment can be expensive.

And if you’re a freelancer, it can be a little scary going through the legal process “on your own”.

So, our advice:

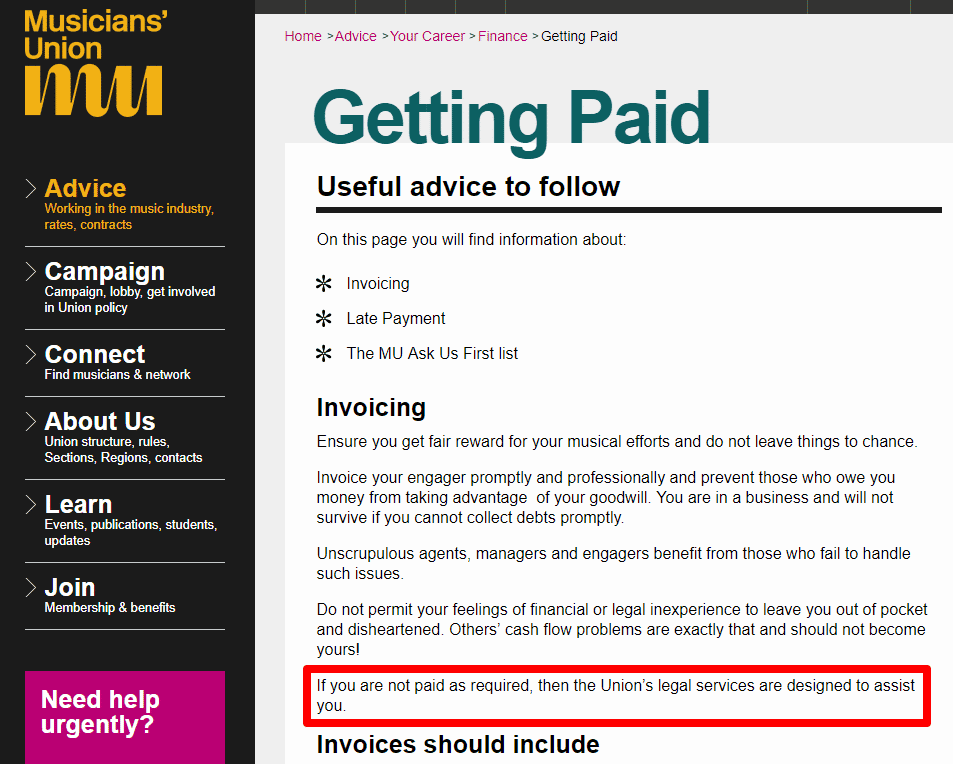

Look into whether there are any trade bodies in your industry and consider joining them. Often your membership will include legal assistance — including help with unpaid debts.

For example, the Musician’s Union state that they offer legal assistance on their “Getting Paid” page.

And the Federation Of Small Businesses (a body for SMEs in the UK) provide debt recovery services for their members.

Trade bodies are normally relatively inexpensive to join. And they offer a wide range of additional benefits in addition to debt recovery.

We’ve included links to trade bodies in several industries below.

General Trade Bodies For Small Businesses & Freelancers

The Freelancer’s Union

Web: https://www.freelancersunion.org/

NFIB: Small Business Association (USA)

Web: https://www.nfib.com/

T: 1-800-634-2669

The Federation of Small Businesses (UK)

Web: https://www.fsb.org.uk/

T: 0808 2020 888

Construction Industry Trade Bodies

Associated Builders & Contractors Inc

Web: https://www.abc.org/

T: (202) 595-1505

Associated General Contractors

Web: https://www.agc.org/

T: (703)548-3118

National Association of Home Builders

Web: https://www.nahb.org/

T: 1-800-368-5242

Plumbers

American Society of Plumbing Engineers

Web: https://www.aspe.org/

T: 847-296-0002

Electricians

National Electrical Contractors Association

Web: https://www.necanet.org/

T: (301) 657-3110

Designers

The Professional Association for Design

Web: https://www.aiga.org

Graphic Artists Guild

Web: https://www.graphicartistsguild.org/

T: 212-791-3400

Musicians

American Federation of Musicians (USA)

Web: https://www.afm.org/

T: 212-869-1330

Musicians Union (UK)

Web: https://www.musiciansunion.org.uk/

Auto Industry

Automotive Service Association

Web: https://asashop.org/

Recap: How To Deal With Unpaid Invoices

If you are a freelancer, or SME, follow these 6 steps to mitigate invoice payment problems.

- Ensure contract is in place for all jobs

- Consider asking for payment in advance

- Send a professional invoice

- Chase up outstanding invoices

- If client still won’t pay, consider legal action

- Consider joining a trade body

The Simple Way To Manage Your Invoices

Managing your invoices, and keeping tabs on late payments is a part of running a business.

At Invoice Simple, our job is to make the process as hassle free as possible.

Check out our invoice generator, and Send Your First Invoice for FREE.

Start Your First

Invoice Today

Create customized and professional

invoices and connect with clients