A Guide to Common Types of Invoices and Price Quotes

In the game of business, invoices are your scorekeepers. They tally up the points—or dollars—earned, making sure you and your customers know the score and play by the rules of getting paid.

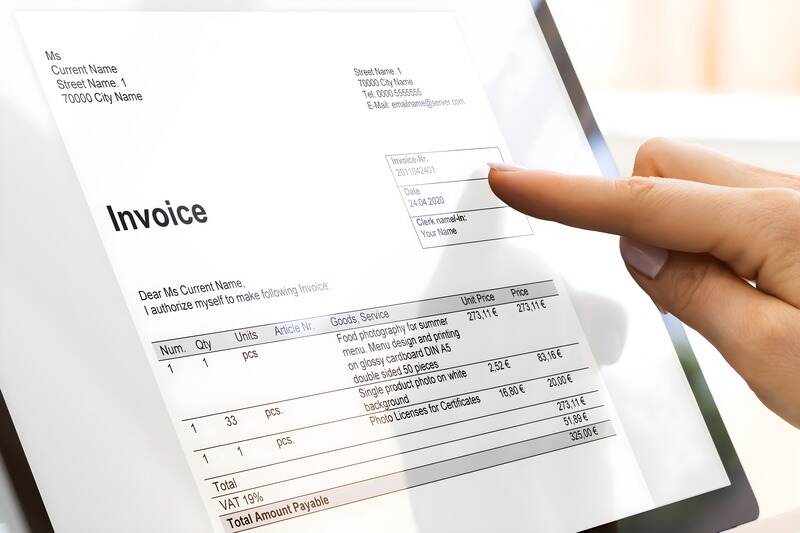

An invoice is a document that shows what a customer bought and how much they owe. And, just as there are many types of businesses, there are many types of invoices. Each has its own role in helping companies track sales and get paid correctly.

In this article, we’ll explore why each type of invoice matters for your business and when to use them. By the end, you’ll be a pro at choosing the right invoice for every situation.

RELATED ARTICLE — Electronic Invoice: What Is It and How Does It Work?

Types of Invoices for Single-Instance Transactions

As a business owner, you often deal with one-time sales or services. This type of invoice tends to be short and sweet.

Let’s look at three types of formal invoices perfect for those quick deals:

Sales Invoice

This is the standard invoice most people think of when they hear the word “invoice.” You send it after you’ve provided a service or shipped an item. A sales invoice is an official request for payment and includes all the important details. That includes:

- Your business info

- The customer’s info

- When payment is due

- How to pay

- An invoice number

- An itemized list of what the customer bought

- How much each item cost

- The total amount due

Pro Forma Invoice

A pro forma invoice is a sneak peek at the final bill. You send it before you do the work or ship the goods. It tells your client what they can expect to pay. It’s great for helping customers budget or for international shipments where customs needs to know the value of goods.

Past Due Invoice

Sometimes, customers forget to pay on time. That’s when you send a past due invoice. It’s a formal reminder note. It shows the original amount owed, any late fees, and the new total (if late fees are added).

RELATED ARTICLE — Accounts Receivable Versus Payable: Differences and Examples

Types of Invoices Sent in an Ongoing Project

Your business might work on big projects that take a significant time to finish. In these situations, you’ll often want to bill clients as the project proceeds.

Let’s look at four kinds of invoices that help you get paid throughout the life of a long project:

Retainer Invoice

This is like a reservation fee. The client sends it at the start of a project to secure your services. It’s common for lawyers, consultants, and agencies. The client pays upfront, and you subtract this amount from the final bill. It’s a great way to ensure you have some initial funds to get started on the work.

Interim Invoice

Think of this as a checkpoint invoice. You send it at different stages of a major project. It breaks down the total cost into smaller, more manageable chunks. This helps you maintain a steady cash flow and lets the client spread out their payments. It’s perfect for work like construction projects and long-term consulting gigs.

Timesheet Invoice

If you charge by the hour, this is your go-to invoice. It shows a detailed list of the hours you and your employees worked and what you did during that time. It’s like a diary of your work with prices attached. Lawyers, freelancers, and consultants often use this type of invoice. They might be issued when the work is finished or at regular intervals.

Final Invoice

This is the grand finale of invoices. You send it when the project is completely finished. It includes any remaining balance the client owes after subtracting previous payments.

RELATED ARTICLE — Invoice Versus Receipt Basics: Everything Business Owners Need to Know

Types of Invoices Issued as Memos

Sometimes, you need to make changes after you’ve already sent an invoice. Memo invoices help you adjust the original invoice as needed.

Let’s take a look at three common types of memo invoices:

Credit Memo

A credit memo reduces the amount a customer owes you. You send it when you’ve overcharged a customer or need to give a refund. For example, you might use a credit memo if a customer returns an item or if you made a mistake on the original invoice. The credit memo shows how much you’re taking off the bill.

Debit Invoice

A debit invoice or debit memo increases the amount a customer owes you. You use it when you’ve undercharged a customer or need to add charges to an existing invoice. This might happen if you provide a product or service you forgot to charge for. The debit invoice shows the extra amount the customer needs to pay.

Mixed Invoice

A mixed invoice includes both credits and debits on the same document. You might use this when you need to make several adjustments to an original invoice. For example, a mixed invoice might show charges for additional services and credits for returned items all in one document. This type of invoice helps you balance out multiple changes without sending multiple documents.

Looking for the right invoice template? With Invoice Simple, you can download one of our free, easy-to-use invoice templates to start. If you need a more customized invoice for your business, check out our online invoice generator for a simple way to create a customized and professional invoice.

RELATED ARTICLE — What Is Remittance Advice? Everything You Need to Know

Other Types of Invoices

These invoices don’t fit squarely into any of the previous categories but may still be useful for your business:

Commercial Invoice

Commercial invoices are crucial for international trade. They include details about the goods being shipped, their value, and the payment terms of sale. Customs officials use this information to determine import duties and taxes.

RELATED ARTICLE — What is a Tax Invoice? Features & When to Use One

Recurring Invoice

If you provide ongoing services or subscriptions, this invoice is a crucial part of your payment process. It automatically bills customers at set intervals, like every month or year. This saves time and ensures regular payments for services like gym memberships and software subscriptions.

RELATED ARTICLE — How to Write a Strong Invoice Email – 3 Examples/Templates

Types of Price Quotes

Customers often want to get an idea of your prices before hiring your services, especially for bigger jobs. That’s what price quotes are for. They help customers understand how much they’ll have to pay before they decide to buy and receive their first invoice.

Some of the different types of quotes you might offer include:

- Product Quote. This lists prices for specific products a customer wants to buy. It includes details like product names, quantities, logistics and delivery information, and the total cost.

- Service Quote. This outlines the cost of services you’ll provide. It might include hourly rates, estimated time to complete the work, and any extra fees.

- Fixed Price Quote. This offers a set price for an entire project, regardless of the time or resources used. It’s great for customers who want to know exactly what they’ll have to pay upfront.

- Request for Quotation (RFQ). This related document is used when a customer asks you to provide a detailed quote for their specific needs. It’s common in business-to-business transactions.

Make sure you don’t forget anything! Here’s a library of templates to help you create professional price quotes. Feel free to download, modify, and use any you like.

FROM ONE OF OUR PARTNERS — How To Invoice Online In 5 Easy Steps

5 Best Practices for Creating Professional Invoices and Quotes

Creating great invoices and quotes isn’t just about listing prices. It’s about building trust and making your business look professional.

Here are five useful tips to help you create top-notch invoices and quotes:

- Use Clear, Formal Language. This ensures your customers easily understand all the information they need to know.

- Include Your Branding. This helps clients quickly recognize documents from your business.

- Be Transparent About Pricing. This builds trust and avoids misunderstandings down the line.

- Offer Multiple Payment Options. This makes it easier for customers to pay you on time.

- Use Invoicing Software. This helps you efficiently create accurate, professional-looking documents.

RELATED ARTICLE — 10 Common Invoicing Mistakes and How To Avoid Them

Create Estimates and Invoices Instantly

There are many types of invoices out there, but that doesn’t have to complicate your invoicing process—if you use the right tools.

Get your invoicing done in minutes, not hours. Create estimates and invoices on the road or at home. Quickly add details such as discounts, payment instructions, due dates, photos, signatures, shipping details, and more. Then, turn estimates into invoices with one click.

Start Your First

Invoice Today

Create customized and professional

invoices and connect with clients