Life as an independent contractor or freelance business owner can be hugely rewarding. You are your own boss, you set your own work schedule, and you have the flexibility to spend more time with the people that matter most. However, it doesn’t come without a series of challenges salaried employees never have to face.

One of these challenges is navigating payment for your goods or services. Typically, independent contractors and freelancers send a document called an invoice to their clients to request payment. But sometimes, invoices are called bills. The question begs: Is an invoice a bill? And if not, what is the difference between a bill and an invoice? Let’s find out.

What Is an Invoice?

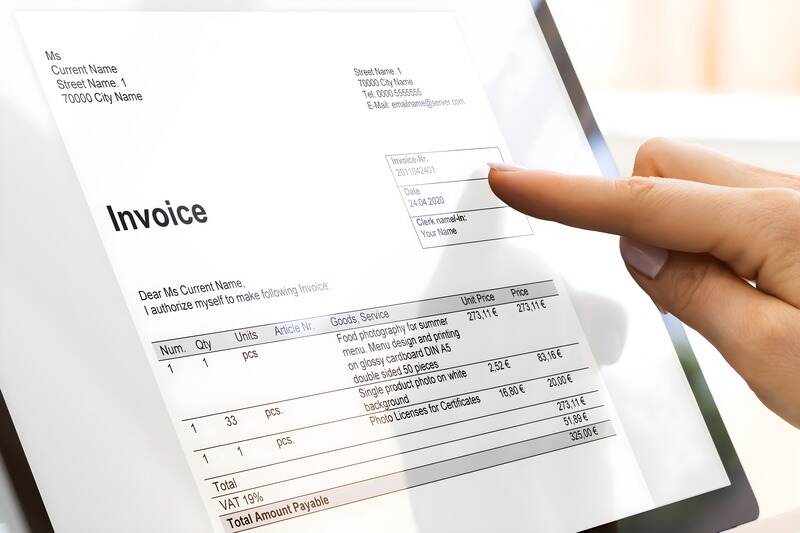

An invoice is a dated commercial document that records the details of a transaction between a buyer and a seller. The buyer and seller can be individuals or businesses. Invoices are essential elements of business accounting, and copies of each invoice are typically retained by all transacting parties—sometimes for tax purposes.

First, it must state that it is an invoice—it must have the word ‘invoice’ clearly marked. Usually, invoices have an invoice number, which is a unique string of letters and/or numbers used for organization and identification.

In addition, invoices include contact information and payment terms. For example, the invoice may require the buyer to make a payment within 30 days of receipt, and it may specify a late fee.

Invoices outline what was purchased (the unit), how many of each product or service was purchased, the cost of each unit, and other expenses, such as shipping and handling and relevant tax charges. Finally, it denotes the total amount owed by the buyer.

Companies, independent contractors, and business owners may choose to send an invoice when the product or service is purchased or delivered or as an end-of-month statement. An end-of-month statement details all outstanding transactions and the total amount owed.

This system is typically preferred by freelancers and contractors with regular clients or longer-term projects. For example, if a freelance copywriter works with one client on six articles throughout the month, the end-of-month invoice would include:

- The details of all six articles

- The cost per article

- Any additional fees

The total amount owed for that one-month invoicing period

In the past, invoices were created by hand on paper. However, as businesses become increasingly digitalized, electronic invoicing—also known as e-invoicing—is preferred. A seller can send e-invoices via email or through their accounting system.

What Does an Invoice Include?

Invoices are required to include different details depending on the country you are operating in and where your client is located. For example, the US doesn’t have a national sales tax like a value-added tax (VAT). So, if you do business in the US, consult both state and federal laws.

Despite some variation in taxes and other requirements, invoices generally always include the following information:

- Seller or business details, including name, address, and contact information (email and phone number)

- Buyer details, including name (or business name) and address

- Invoice date

- Invoice number

- Details of the products or services purchased, including the number of units (this could be measured in the number of hours worked, for example) and cost per unit

- Payment terms, including the due date and late fees

- Payment method and details, such as credit card or wire transfers

- Applicable taxes

- Total amount owed

What Is a Bill?

The terms invoice and bill are often used interchangeably, but there are some nuanced differences between the two. So, to get to the bottom of the invoice vs. bill debate, we need to get clear about what a bill actually is.

Similar to an invoice, a bill is a commercial document sent by a seller to a buyer detailing the amount the buyer owes for products or services they received. A bill is issued before payment is sent, provides a record of a transaction, and serves as a reminder to the buyer to make a payment. Generally, payment is expected immediately upon receipt or shortly after.

So far, so good. Now, let’s introduce a third player into the mix: bill vs. bill of sale vs. invoice. We’ve already established that an invoice and bill aren’t always the same thing (we’ll explore the key differences below), but what about a bill and bill of sale? After all, they both use the word ‘bill.’

While a bill focuses on collecting payment from a buyer, a bill of sale is a legal document that provides evidence of the transfer of goods or property from one person (or business) to another. It confirms that the seller has assigned ownership and the rights to an asset to the buyer.

Where does a receipt come into play? Let’s briefly consider invoice vs. receipt vs. bill. An invoice and bill are payment requests. In contrast, a receipt is proof of payment. Invoices and bills are typically issued before payment is received, whereas receipts are issued after payment is received.

KEEP READING: Invoice vs Receipt – Is an Invoice the Same as a Receipt?

What Does a Bill Include?

A bill usually includes all the same information as an invoice, such as buyer and seller details, date of issue, details of the products purchased or services rendered, applicable taxes, payment information, and the total amount owed.

The Differences Between Bills and Invoices

The differences between bills and invoices can be categorized into three main characteristics: perception, payment timeframe, and included details.

- In some cases, the difference between a bill and an invoice comes down to perception. As a contractor or freelancer, you might send an invoice to a client at the end of the month. Your client, on the other hand, might call the document they received a bill. They are required to make a payment, which means, for all intents and purposes, the outcome is the same as if they received a bill at a restaurant or their phone bill.

- Generally, a bill has a shorter timeframe in which a payment can be made. That’s why service providers (for example, electricity providers) tend to send bills, not invoices.

- Finally, the details included in an invoice are more geared toward record keeping and inventory tracking. That’s why businesses use unique invoice numbers and, in some instances, include product codes.

The below table summarizes the differences between bills and invoices.

Invoice vs. Bill

TimingSent after the products or services are received. Usually sent after the products or services are received but can be issued at any point during the process.

| Feature | Bill | Invoice |

| Details of sale | Sent by companies that require prompt payment. Details of sale are kept to a minimum, and information focuses on fast and easy payment. | Used for tracking, tax, and inventory purposes. Details of the sale are included in full. |

| Timing | Sent after the products or services are received. | Usually sent after the products or services are received but can be issued at any point during the process. |

| Invoice and order numbers | May not include a unique identifying number. | Include unique invoice numbers and, sometimes, unique order numbers. |

| Payment expectation | Usually request immediate payment and don’t provide payment terms. | Usually state a due date (for example, 30 days). |

Examples of Bills and Invoices

When should you send a bill, and when should you send an invoice? The answer depends.

If you run a company that requires quick payment, such as an internet service provider, hair salon, or café, bills may be a better choice. In contrast, an invoice may be the way to go if you supply services or products that require manufacturing or creating, such as custom furniture or web development.

Let’s say you run an Italian restaurant. Your customers can’t leave the restaurant before they pay for their meal. You require immediate payment and accept just two payment options: cash or card. A bill is the better choice. An invoice would include more information than needed.

Now, let’s say the owner of an Italian restaurant contracted you to redesign the interior. This service involves a month-long process with many moving parts — sourcing furniture, hiring and managing subcontractors, and so on. It’s a significant time commitment on your behalf, so you may like to issue an invoice for a 50 percent deposit before works begin. When complete, you would then issue a second, itemized invoice with details of all services rendered and specific payment terms.

How to Prepare an Invoice or Bill

Achieving success as a contractor or freelancer demands exceptional customer service before, during, and after a product or service is sold. Your commitment to customer experience should also extend to invoicing and billing.

Invoicing Etiquette

Before you prepare and send an invoice or bill, ensure your customer is expecting one. If they are surprised by your invoice, they may be less inclined to pay on time. Here’s how this might work in practice:

- Before you enter into an agreement with a new customer, set invoicing expectations. Let them know that you invoice on delivery, invoice at the end of each month, or require a deposit.

- Follow through on your invoicing promises. If you say you’ll invoice at the end of the month, don’t send one on the 15th.

- If you haven’t established and communicated your invoicing practices with a customer, you can send them a short email informing them that an invoice will soon be raised. If they are an ongoing customer, you can use this opportunity to establish your invoicing practices moving forward.

Invoicing Preparation

Invoices require a lot of specific information, and that information must be accurate. To avoid invoicing mistakes, ask yourself the following:

Who pays?

Sometimes, the person you deal with directly is not the person who pays the invoice. In some cases, the person you’re in contact with will review and approve your invoice before forwarding it to the relevant person or department (such as the bookkeeping or accounting department). In other cases, you will send the invoice directly to the person responsible for paying you. Make sure you know who to send the invoice to beforehand.

What payment types can you accept?

Some payment types will be easy for your client but a headache for you. Others simplify your life but complicate things on your client’s end. The best workaround? Accept several different payment options, such as credit card, direct deposit, check, and online payment services like PayPal.

What are your payment terms?

Payment terms tell your client when their payment is due. Some industries customarily use specific payment terms, such as 30 days from receipt (sometimes written as Net 30). However, you can alter your payment terms to meet your needs. You can also offer incentives (such as discounts) for early payment and charge late fees.

Next, you need to create a unique invoice number. Generally, invoices are numbered systematically — for example:

- Sequentially, e.g., 000023, 000024

- With a customer code, e.g., SMI0023, JON0024

- With the date, e.g., 0522-0023, 1022-0024

Select a system that makes sense to you and stick with it.

Then, collate the details of the transaction. You can use the features listed in the ‘What Does an Invoice Include?’ section above as a starting point.

Finally, it’s time to put everything together. Many contractors and freelancers use an invoice template in which they can input the relevant information. You can find many different invoice templates online or pre-saved in your preferred word processing software.

How to Present Bills and Invoices to Customers

Generally, invoices are emailed to clients when the work is completed. However, you can invoice for longer projects or ongoing assignments at the end of each month.

Invoices are usually saved as PDFs and attached to a brief and polite email. Do not present your invoice as a Word document or other editable file format.

If you’re stuck on what to write, here’s a simple invoice email template:

Subject: Invoice for [project details]

Hi [client’s name],

Please find my invoice for [project] attached to this email. As discussed, the total amount is [total amount owed], payable by [your preferred payment method] by [due date].

Reach out if you have any questions. Thank you, and I look forward to working with you again.

[Signoff, e.g., Kind regards, Best, etc.]

[Your name]

Navigating Invoices and Bills

Invoicing and billing can be tricky to navigate at first. But with a robust and organized system in place, you can ensure your clients pay you in full and on time. Get started with invoicing today using our Free Invoice Generator.

Start Your First

Invoice Today

Create customized and professional

invoices and connect with clients