How to Calculate & Charge Late Fees on Invoices

How to Charge Late Fees on an Invoice (with Example)

Did you know that on average, small businesses spend 15 days each year chasing down late invoice payments?

Not only is that an annoying statistic, but it’s also a costly one. You could spend those days working on other projects (and getting paid for them), sealing other deals, or relaxing at home with your family. It also goes without saying that late payments limit your incoming cash flow and can create more problems for your accounting over time.

Even though 54% of businesses expect to have to deal with late payments, that doesn’t have to be your reality. Charging late fees on invoices will encourage clients to pay on time. And it’ll put a little extra money in your pocket when invoices become overdue.

This article will cover how to charge payment late fees on an invoice and invoice late fee wording. We’ll also give you some examples to use when writing late fee emails and talking about overdue invoices with clients.

Let’s get started!

How Do I Charge Late Payment Fees on an Invoice?

The best way to go about charging payment late fees on an invoice is the best way to go about most things—good communication.

By clearly communicating your late fee policy to clients from the start, you’ll be able to set expectations for payment right away. This can help you avoid some awkward conversations down the line. Plus, making clients aware of late fees will discourage late payments in the first place.

Including your late payment policy and fees in your initial contract with clients is the most effective way to ensure everyone is on the same page about them. You should also include this information in the “terms and conditions” section of every invoice you issue.

Another important reason to communicate your late fee policy from the get-go is that late fees are only legal if outlined and agreed upon in your original client contract or payment terms.

But what if you forget to outline your late fees in a contract before delivering your services? Are you just out of luck if the client pays late?

Well, it depends.

You can still try to charge late fees after the fact if a client doesn’t pay their invoice on time, but you won’t have much legal power to enforce it. They could refuse to pay the late fee since it was never agreed on.

If you find yourself in this situation, we recommend consulting a legal professional about your options.

(Did you know? You can add late fees to your invoices as a line item using Invoice Simple. Try it for free!)

How Much Can I Charge for Late Fees?

The most common way to charge a late payment fee is to apply a percent interest to the original overdue amount. Different states have different laws about the maximum annual interest rate you can charge on late invoices, so be sure to research the regulations for your state.

How to Calculate Invoice Late Fees

Once you know your state’s maximum annual interest rate, you can set your own annual or monthly late fee interest rate. If you set an annual rate, simply divide it by 12 to get your monthly late fee rate.

Then, you can use this equation to calculate the late fee on an overdue invoice:

(Total Payment Owed) x (% Monthly Late Fee Rate) = Late Fee

So, let’s say your state allows a 12% maximum annual interest rate. You decide to go with the maximum because why not get your money’s worth, right? That makes your monthly late fee rate 1% (12% ÷ 12 = 1%).

Now let’s say you have a client with a late invoice for $1,000. Here’s what their late fee would be:

($1,000) x (.01) = $10

And that makes their new total invoice:

($1,000) + ($10) = $1,010

But what if our example client’s invoice is more than one month overdue? Do you add another $10 to their total after a month? Or would you calculate a new late fee based on their new total of $1,010? If you do the latter, that would be charging compound interest.

The laws on charging compound interest for late fees also vary based on your state. Some allow it and others don’t. Some allow it up to a certain amount. Again, you’ll have to do your research and decide what policy works best for your business.

What Is the Standard Late Fee on an Invoice?

For small businesses, a standard late fee for an overdue invoice is typically 1-1.5% monthly. Experts also recommend 10% annual interest as a good benchmark since you likely won’t be over the cap in most states.

Ultimately, however, the right late fee for you will depend on your business. Here are a few things to consider when deciding when to apply a late fee and how much to charge:

- Whether you want to keep the client’s business

- Your brand style and personality

- Your relationship with the individual client

- The client’s payment history

Invoice Late Fee Wording (and Example Invoice)

Asking for money from people is never fun, even when it’s owed. It can be tricky to navigate the conversation in a way that keeps things cordial while still ending up with the money in your pocket.

Again, the most effective way to charge late fees is to put it in your initial contract and invoice terms. Here’s a checklist of what information to include in your invoice late fee wording:

- Late fee rate

- Invoice number

- Amount owed

- Services purchased

- Payment due date

- When late fees apply

- Instructions for payment

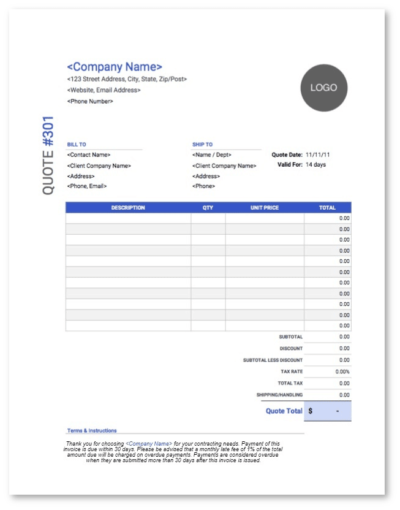

And here’s an example of invoice late fee wording you can use in your contract:

[ “Thank you for choosing Jeff’s Contracting for your contracting needs. Payment of this invoice is due within 30 days. Please be advised that a monthly late fee of 1% of the total amount due will be charged on overdue payments. Payments are considered overdue when they are submitted more than 30 days after this invoice is issued.” ]

How to Write an Email for an Overdue Invoice with Late Fees

Unfortunately, as a small business owner, overdue invoice emails are something you’ll likely have to write more than once. Creating a template for these emails will help make them easier and keep them professional.

Here’s what your email template for overdue invoices with late fees should include:

- Invoice number

- Services delivered

- Original invoice due date

- Late fees charged

- New total due with late fees

- Instructions for payment

- Original invoice attachment

Make sure you’re clear and direct about late fees and what’s owed in your email while keeping it professional. And try to make it as easy as possible for the client to pay their invoice.

Overdue Invoice with Late Fees Email Template

Subject: Urgent: Invoice #12345 Past Due

Hello [Client Name],

I hope you’re doing well. I just wanted to remind you that invoice #12345 was due on [due date] and is now overdue. As per the late payment policy outlined in our contract, a late fee of X% has been applied to your balance.

For your convenience, I’ve attached the original invoice and an updated invoice reflecting the new balance due. If circumstances are preventing you from making your payment, please reach out as soon as possible so that we can discuss an alternate solution.

Please submit your payment by [due date] and respond to this email confirming that you’ve received the updated invoice and that your payment has been sent.

Thank you,

[Your Name]

KEEP READING: How to Write a Past Due Invoice Email

How Do I Explain Late Fees to My Customers?

When explaining to your customers that they’re being charged late fees, be as clear and informative as possible. You may feel weird about telling a client they’ve incurred extra charges, but it’s your right as a service provider to enforce your policy and collect what’s owed.

In our email template above, you’ll find everything you need to include when explaining late fees to your customers. Here are the key points to hit on:

- Original payment due date

- How far past due the invoice is now

- New amount owed with late fee applied

- Due date for new balance

Remember, it’s always better to explain your late fee policy to clients before you deliver their services. That way, if you end up with an overdue invoice, you can point back to your original contract when explaining that late fees have been applied.

KEEP READING: Unpaid Invoices: A Simple Guide for Freelancers & SMEs

How Do You Politely Ask for Late Payments?

When you’re reaching out to clients about late payments, remember that you don’t know their circumstances yet. Sometimes, things happen.

A client’s invoice may be overdue because your email went to their spam folder. Or they may be waiting on a check to hit their account before submitting payment. Sometimes, a client may even forget.

When you first approach your clients for late payments, give them the benefit of the doubt. Gently remind them that their payment is overdue and offer them one last chance to pay before incurring late fees.

Initiating late payment conversations with kindness and understanding may save you more than one valuable client relationship over your business’s lifetime.

If a client hasn’t responded to one or more late payment emails, give them a call. A phone call will be more direct and allow you to have a straightforward, open dialogue about the situation.

How to Deal with Extremely Late Invoices

Let’s say you’ve sent multiple emails to a client with an overdue invoice and called several times. And now, months have gone by, and their balance has gone unpaid and continued to increase with all the late fees. What should you do now?

First of all, don’t give up. You may be tempted to call it a wash and write it off on your taxes, but you shouldn’t. You’ve earned that money and deserve to be paid for your hard work. Also, you don’t want word to get around that you let late invoices slide.

If your polite and increasingly urgent late payment reminders are having no effect, it may be time to get a lawyer involved. They can write and deliver a payment demand letter for you and, if you choose, help you take your case to court or find a collection agency.

Whether or not you decide to take your client to court, you should still make other business owners aware that they’re not a dependable person or business vendor to work with. You can do this with brodmin—an independent directory of late and non-paying clients and businesses.

Business owners can go to brodmin’s website to report clients and business vendors who haven’t paid their invoices.

The goal is to help other business owners avoid the same fate of an unpaid invoice by providing a resource where they can research clients before working with them. By documenting frequent offenders, you’re helping them make better decisions.

KEEP READING: Invoicing Tips: Can You Write off Unpaid Invoices?

Make Invoicing Simple

Navigating late fees for overdue invoices—and even just creating invoices in general—can be a stressful and time-consuming process. But by using our simple tips and examples to guide you, you can start charging late fees on your invoices confidently and professionally.

Need more help with adding late fees to your invoices? Use Invoice Simple’s free invoice generator to include line items for late fees and notes for payment terms. We’ll take the hassle out of your invoicing process.

Start Your First

Invoice Today

Create customized and professional

invoices and connect with clients