How Does Invoicing Work? A Step-By-Step Guide

Sending an invoice is about more than just charging your customers what they owe.

It also creates records of business transactions, payments received, and any amounts owed. Without a working knowledge of invoicing, managing your small business finances will be impossible. And with so many different types of invoices, you need to know more than what an invoice is to keep things organized.

So, how does invoicing work, and why are there so many types? Let’s find out.

RELATED ARTICLE — What is a Commercial Invoice?

What Is a Business Invoice?

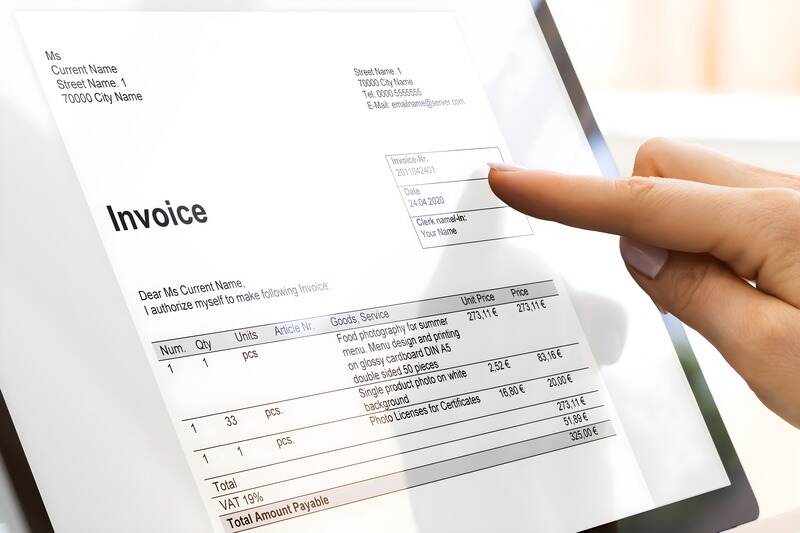

A business invoice is a document that lists the services or products you sold to a customer. It includes the total amount the customer needs to pay and how they can pay you. Most also include an invoice number for tracking transactions and a payment deadline.

RELATED ARTICLE — How to Write an Invoice for Freelance Work

What Are the Different Types of Invoices?

Each type of invoice serves a different purpose, and you might have to issue several different types to clients. Below is a list of common invoices and what they’re used for:

- Proposal (or bid). This is an estimate of the cost before starting a project, which is common with independent contractors who provide a service. It details the expected costs of the work to help clients decide to work with you or your company.

- Interim (or progress) invoices. These are sent during a large project to request payment for parts of the work that have already been completed. Getting lump sum payments in stages helps businesses maintain cash flow throughout the project.

- Timesheet invoices. When billing is based on the amount of time worked, these invoices are submitted. It’s commonly used by freelancers and contractors who charge by the hour.

- Pro forma invoices. A proforma invoice is a preliminary bill of sale. It’s like a preview of what the client must pay when the job is complete. It’s sent to buyers before a job is started as an estimate of the work to be done.

- Final invoices. A final invoice is sent after all work on a project is done. It requests the remaining payment due and shows that the transaction between the business and the client is over.

- Past-due invoices. These invoices are reminders sent to clients when payments are overdue. They’re a polite way to remind clients they still owe you.

RELATED ARTICLE — What Is Invoice Factoring?

How Does the Invoicing Process Work?

The invoicing process is how you get paid for your work or sales. Without a proper invoicing process, your clients might not understand what or how much they owe.

Follow these steps and get your payment process running like a well-oiled machine:

1. Offering Products or Services

Start by providing your agreed-upon products or services to your client.

It’s important to agree on the price, terms, and payment method of any work upfront, as this helps avoid any disagreements down the road. For example, if you don’t accept checks, make sure they know that in advance.

It helps to have contracts with clients that include a list of what services you’ll provide. This can be a scope of work to help make it clear what you will and won’t do. For a freelance writer, it might mean outlining that you’ll write blog posts for your client but not copy for landing pages. That helps you both understand what’s expected of your working relationship.

RELATED ARTICLE — How to Convert an Estimate to an Invoice: A Step-by-Step Guide

2. Generating an Invoice

Once your work is complete or your product is delivered, it’s time to create an invoice. If you own a business, learning how to do an invoice correctly is essential. Include details like the services, cost, and payment deadline.

This process is even easier if you use invoicing software like Invoice Simple. It prompts you to complete all necessary fields to make sure you don’t forget anything. Plus, you can customize them to have your branding elements on them. This ensures every invoice you send looks professional.

FROM ONE OF OUR PARTNERS — The 7 Best Invoice Software Options for Small Businesses

3. Sending the Invoice

Typically, it’s the seller or service provider who sends an invoice to the buyer to ask for payment for the products or services delivered. If you’re sending it through the mail, it’s a good idea to contact your client by email or phone, letting them know when to expect it.

With invoicing software, you can send it easily by email or directly from the platform. This makes it easy for you and your client and allows for quicker payments.

4. Payment Confirmation

After the customer pays, always confirm that the payment has been received. There might be processing delays, depending on how they pay or the size of the payment. Larger sums might take longer to process.

Most online invoicing tools, like Invoice Simple, notify you automatically when a payment is made, so you don’t need to keep checking your email. This also helps you stay on top of your cash flow and send thank you messages to clients for their business.

5. Updating Records

Once payment is confirmed, update your business records. Good record-keeping is a must for staying organized, tracking income, and simplifying paperwork.

This is especially true when tax season arrives. It’s vital to understand what an invoice in accounting represents, as this knowledge helps you keep correct financial reports. Limit mistakes by using software that does it all automatically for you.

6. Receipt and Acknowledgment

Send a receipt to your customer as proof of payment. This shows your client that their payment has been received and processed. It’s a small but important step so you and your client both have a record of the transaction.

FROM ONE OF OUR PARTNERS — How To Invoice Online In 5 Easy Steps

7. Reconciliation

Review your records to check the payment matches the invoice. This step can help you fix any mistakes and keep your books in good standing.

With Invoice Simple or similar tools, you can cross-check payments and invoices, making the process less stressful.

8. Resolving Payment Issues

If the payment is late, incorrect, or missing, it’s important to act quickly. Contact the customer professionally to resolve the issue. You may need to send a reminder, change the invoice, or work out another payment plan.

Invoicing software can send automated reminders on your behalf, making it easier to follow up.

RELATED ARTICLE — How to Send an Invoice

Online Invoicing Versus Paper Invoicing

Paper invoices are printed and mailed, while online invoices are sent electronically through email or special software. Many businesses now prefer online invoicing (or e-invoicing) because it’s faster and easier to manage.

Here are some of the benefits of using online invoicing:

- Faster payments. Customers can receive and pay invoices instantly.

- Better cash flow. You get paid sooner, which helps your business run smoothly.

- Easier to track and manage. You can keep all your invoices in one place and see what has been paid.

- Fewer materials to expense. Buying paper, envelopes, or postage is not needed when you send an electronic invoice.

RELATED ARTICLE — Electronic Invoice: What Is It and How Does It Work?

The 8 Best Practices of Invoicing

Invoicing is an integral part of running a successful business, helping you get paid for the work you do. To make the process smoother and faster for you and your clients, follow these best practices when creating invoices:

- Keep it Simple. Your invoice should be clear and easy to understand. For example, if you’re a web designer, don’t overload the invoice with industry terms. List your services simply, such as “designed new blog” or “fixed broken redirects,” so your customers can quickly see what they’re paying for.

- Add Branding Elements. Your invoice is part of your brand, so it should match your business’s look. For instance, if you run a roofing company, include your logo and use the same colors as your business cards or website. This makes your invoice look professional and creates a cohesive brand identity.

- Include Dates and Invoice Numbers. Always include the date and a unique reference number. If you’re an electrician juggling many jobs, having a clear date and reference number helps you and your client keep track of payments.

- Address the Person Directly. It’s important to include the correct invoice address so the invoice reaches the right person. And if you’re dealing with business-to-business transactions, don’t just send an invoice to the company. Address it to the person you worked with. For example, if you did a project for a marketing agency, address it to the site manager who hired you.

- Include an “Appreciation” Note. A simple “Thank you for your business” can go a long way. A small note at the bottom of the invoice, like “We appreciate the opportunity to work on your project,” makes the invoice feel more personal.

- Describe Invoice Items. Be specific about the work you’ve done. Instead of writing “Labor,” describe the task.

- Include the Total, Due Date, and Payment Terms. Always write out the total amount due, when it needs to be paid, and the payment terms. For instance, if you’re a consultant, you might include “Total Amount: $500.00. Due: 30 days from invoice date. Payment terms: Net 30.” This lets your client know exactly when you expect the payment and how much to pay.

- Include Payment Options. Make it as easy as possible for your clients to pay you. Offer different options like bank transfer, credit card, or even mobile payments. Providing many ways to pay can help you get your money quicker. And mentioning the payment types you accept on the invoice saves clients from wondering how to pay you.

RELATED ARTICLE — A Step-By-Step Guide to Efficient Invoice Processing

Create Estimates and Invoices Instantly

Making invoicing as simple as possible can save you valuable time and help you get paid faster. That’s what Invoice Simple is best at.

With our invoice software, you can create estimates and invoices with just a few clicks. Add essential details like discounts, payment instructions, photos, and more to make getting paid even easier.

Simplify the invoicing process with Invoice Simple.

Start Your First

Invoice Today

Create customized and professional

invoices and connect with clients