Electronic Invoice: What Is It and How Does It Work?

Issuing an invoice is simple in person. You just write down the details and give them to the customer.

So when you’re used to paper, electronic invoices—also known as e-invoices—may seem complicated. Why fill them out online when physical ones work just fine? But e-invoices actually make the billing process easier. You can better personalize your invoices, remind customers about payment deadlines, and integrate them with your accounting system.

Here’s how to share invoices with a single click.

What Is E-Invoicing?

Many believe any invoice sent online is an e-invoice. But there’s more to it than that.

E-invoices are made with specialized software that offers more capabilities, like data reports and automations. And while these documents are digital invoices, they must meet certain criteria to be true e-invoices. These requirements make sure the invoice meets legal standards and is secure for businesses worldwide.

To be an e-invoice, a document has to:

- Be in a digital format, like EDIFACT, XML, PDF, or X12

- Travel electronically from one computer to another

- Remain unaltered and unedited, keeping it accurate and trustworthy

- Contain all vital information, like the date and amount due

RELATED ARTICLE — How To Send an Invoice

Understanding the Mechanics of Electronic Invoicing

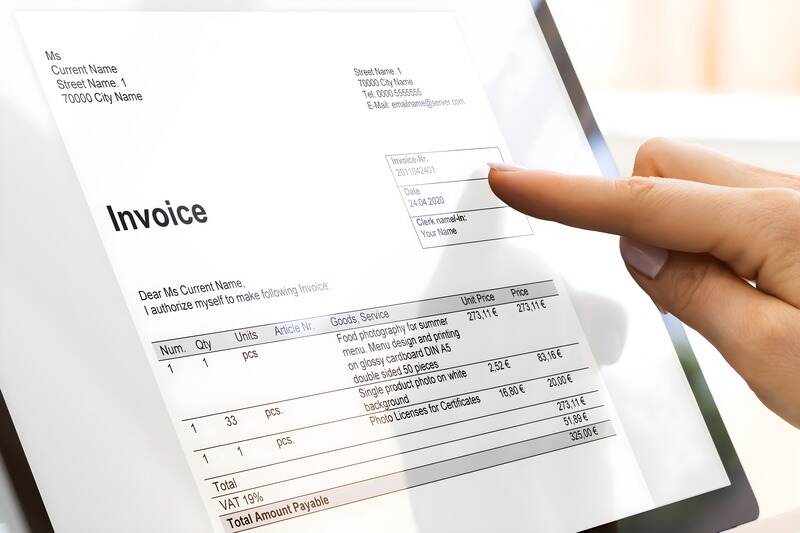

E-invoices contain the same necessary information as paper invoices, like:

- The date

- Invoice number

- Company name and logo

- Customer business information

- Description of goods or services rendered

- The amount due

- Payment methods and terms

Including all of this information keeps you and your customers on the same page. If there’s ever a dispute, you can both point to the invoice as a source of truth.

But the e-invoicing process goes beyond sending the invoice itself. Modern software, like Invoice Simple, can track the details for you and even automate parts of the process. For example, it automatically sends a client a message a few days before their payment is due. This saves you time and reduces late payments.

You can also customize your invoices using templates that make your business look more professional. Just plug in your payment information, due dates, and even your signature. Plus, software like Invoice Simple lets you save repeat customers’ information for later.

A digital invoice management system lets you focus more on growing your business and less on handling paperwork.

FROM ONE OF OUR PARTNERS — Advantages of Electronic Invoicing and Billing

Comparing Electronic and Digital Invoices: What’s the Difference?

E-invoices are a more specific type of digital invoice. Here’s a breakdown of how each works.

Digital Invoices

- Broader Range of Formats. Digital invoices can be in various formats, such as PDFs or scanned paper invoices.

- Convenience. These formats are easy to create and share via email or other digital means.

- Basic Features. Digital invoices have basic features. They often can’t connect with accounting software and lack advanced options, like real-time tracking.

- Manual Work. Managing digital invoices requires a lot more time and effort. You have to personally handle things like tracking, entering data, and following up with customers.

E-Invoices

- Specialized Software. E-invoices use specific software to create, send, and receive invoices.

- Automation. To make payment and other processes easier, e-invoice software automates tasks.

- Seamless Integration. E-invoices can usually connect with your existing accounting systems. That means it’s much easier to make calculations and holistically track transactions.

- Advanced Features. E-invoicing systems have more features, like real-time tracking, automated reminders, and detailed reports.

FROM ONE OF OUR PARTNERS — What Is Payment Processing?

11 Invoice Types: An Overview

Digital invoicing systems can create different types of invoices depending on your needs. Here’s a breakdown of the most common invoice types and their uses:

1. Sales Invoice

A sales invoice is the most popular type of electronic invoice. It’s used to request payment for goods or services sold. It includes details like:

- Supplier and customer information

- Invoice number

- Description of goods or services

- Amount owed

- Payment deadline

- Accepted payment methods

2. Pro Forma Invoice

You give a pro forma invoice before delivering goods or services. It’s more formal and detailed than an estimate and acts as a statement of work. You and the customer use it to agree on payment and deliverables. It includes:

- Detailed cost breakdowns

- Description of the work

- Terms before the final sale or agreement

- Any other information needed to inform the customer before the final agreement

3. Past-Due Invoice

Send a past-due invoice to customers who haven’t paid by the due date. They may include late fees, and you should send them as soon as possible. They should also contain all details from the original sales invoice.

4. Credit Memo

A credit memo, or credit invoice, is used to give a discount or refund. This is often due to damaged goods or invoicing mistakes.

5. Debit Memo

A debit memo, also called a debit invoice, indicates an increase in the customer’s owed amount. If your business uses more time and resources than originally estimated, you send a debit memo.

6. Mixed Invoice

This kind of invoice combines new credit and debit charges into one invoice, with the net amount reflecting what the customer owes.

7. Commercial Invoice

If you do business with customers in another country, you use a commercial invoice. This type of invoice helps you send goods anywhere in the world smoothly. This invoice includes:

- Customs classification

- Quantity

- Weight

- Volume

- Description

- Price of the goods

8. Timesheet Invoice

A timesheet invoice tracks hours worked. Lawyers, consultants, and other professionals who charge by the hour or day use this type of invoice. It shows the number of hours worked and the hourly rate.

9. Interim Invoice

Interim invoices are for large projects that happen in stages. You send these invoices for partial payments when you reach set milestones. This helps manage cash flow for long-term projects.

10. Final Invoice

At the end of a big project, you send a final invoice. This shows the total amount owed after subtracting any payments made during the project. It makes sure all remaining balances are paid. It usually includes:

- A detailed breakdown of the total project cost

- Any previous interim payments

- The final amount due

11. Recurring Invoice

You use recurring invoices for continuous services. These invoices are issued monthly or at other regular intervals.

RELATED ARTICLE — 10 Common Invoicing Mistakes and How To Avoid Them

4 Steps for Creating Electronic Invoices

Follow these four simple steps to transition to e-invoicing and take advantage of its benefits for your business.

1. Notify Customers

Inform your customers about your switch from physical or digital invoices to an electronic system. Tell them the date they can expect the new format.

Most new processes will happen behind the scenes, but if anything changes for them, let them know. For example, e-invoices might come by email instead of mail. Invoice Simple lets customers pay from the invoice itself, making things easier for both customers and you.

2. Implement the System

Choose an e-invoicing system that integrates with services you already enjoy, like PayPal and Stripe. This makes it easier to set everything up. Make sure to train your team on how to use the new system.

3. Create the Invoice

Use your new system to start creating invoices. Many services offer professional, customizable templates that make the whole process much faster.

Input all necessary details, including:

- The date

- Invoice number

- Customer information

- Description of goods or services

- Amount due

- Payment terms

Ensure the information is accurate before sending.

4. Send the Invoice

Once you’ve created the invoice, send it to your customer through the e-invoicing system. The secure system makes sure the invoice reaches the customer securely. You should be able to track the invoice status to check receipt and follow up if necessary.

RELATED ARTICLE — Creating an Effective Invoice Number System: Best Practices

How E-Invoicing Streamlines Financial Operations

If you’re not convinced, here are the benefits of using an invoice management system. You can:

- Decrease costs. Sending documents online reduces the need for paper, printing, and postage. This leads to significant cost savings.

- Improve response times. E-invoices are delivered instantly. Because of this, you can speed up the payment cycle and improve your cash flow.

- Trust secure communications. Invoicing systems use secure channels to send invoices, which protects sensitive financial information.

- Maintain document integrity. E-invoices can’t be altered or edited. You don’t have to worry about unauthorized changes or data corruption.

- Integrate with most management systems. Most e-invoicing solutions integrate with existing financial and accounting software. Having this feature helps you manage your invoices and payments.

- Spend less time on administrative tasks. Using an e-invoicing system reduces the time you spend doing paperwork. You can focus on what matters the most—running your business.

RELATED ARTICLE — Creating an Effective Invoice Number System: Best Practices

5 Tips for Choosing an Electronic Invoice Software

Knowing the advantages of e-invoices is a good first step. The next is finding invoice software that fits your unique needs.

Here are some invaluable tips for choosing the best electronic invoicing system for your business:

1. Centralized Financial Tracking

Choose a system that tracks your small business finances in one convenient place. This puts all your client details right at your fingertips so you don’t bounce back and forth between software.

2. Real-Time Notifications

Make sure the software sends notifications when invoices are delivered and read. This feature helps you avoid worrying about undelivered or missed emails.

3. Outstanding Invoice Tracking

Choose software that shows you which invoices are unpaid. It should also track their due dates and remind clients when and how they can pay.

4. Automated Income Reports

Look for software that automatically creates reports on your monthly and yearly income. You can identify top clients and the most profitable months, giving you the information you need to prioritize accordingly.

5. Accessible Report Exporting

You should be able to export and send reports to your accountant or team members with one click. This simplifies bookkeeping and tax preparation, making the entire process a breeze.

RELATED ARTICLE — Invoice Versus Receipt Basics: Everything Business Owners Need to Know

Use Invoice Simple for Streamlined E-Invoicing

If you don’t yet use e-invoices, you’re falling behind. Start with Invoice Simple, the invoicing software with easy setup and smooth automations.

Invoice Simple sends alerts when your invoices are read and lets you easily track due dates. You can easily keep a list of clients and monitor your monthly income with built-in reports. And you’ll access unique templates that help you make beautiful, professional documents.

Start Your First

Invoice Today

Create customized and professional

invoices and connect with clients